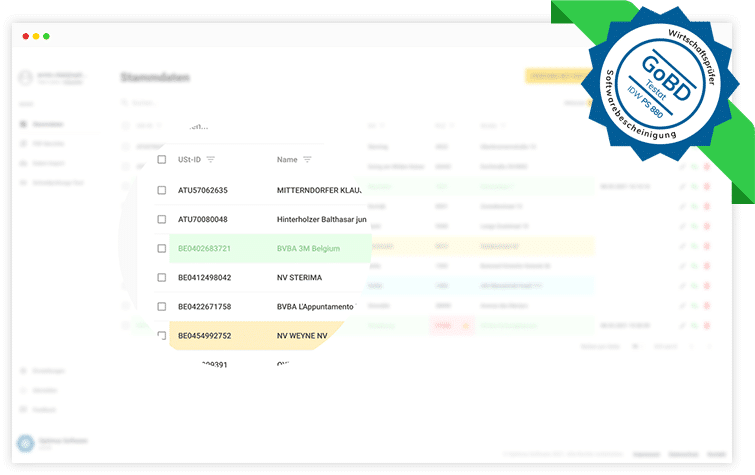

Fully automated VAT ID check & Master data maintenance

With one solution you fulfill the legal requirements regarding the VAT audit for intra-community deliveries. Simple, fast and secure!

Save enormous efforts with the online VAT ID checker

What our partners and customers say

Optimus overview

0+

Users

0+

Daily queries

0+

Years expirience

Simple integration

You can use our UST-ID checker stand-alone or directly as an integration.

Can the UST-ID checker also be used independently?

Online UST ID checker is designed to be used both standalone and as an integration. Which is very accommodating for small and medium sized businesses.

Is stand-alone also possible with automatic testing?

Even in stand-alone mode, complete automation is possible without any programming or integration effort. Feel free to arrange a non-binding live demo appointment with us directly. We will show you all the options for saving work and preventing risks.

How can I test the software?

You can test our software HERE free of charge and without obligation. You do not need to enter any payment data. If you decide to purchase and order the software, payment will be made by invoice. We do not collect any payment data.

Easy data transfer from other systems

The data transfer is ensured within a few seconds, thanks to our intuitive interface and intelligent recognition of the data. Pre-preparation of the data is not necessary.

Complete data determination only on the basis of the VAT ID

The online VAT ID checker is able to identify all the correct address components based only on the VAT ID and even return them in a structured form.

Do you know an easier way to maintain master data?

The online VAT ID checker detects the incorrect entries in your data and suggests a correction, which you can apply with one click.

Integrated quick check tool

With the built-in quick check tool, you can easily and quickly check VAT ID numbers while determining the company data. Now in the new version also for GERMAN and SPANISH VAT IDs.

Automatic background check with e-mail monitoring

Continuous checking of inserted master data with automatic PDF report archiving. E-mail monitoring notifies you when incorrect records are created. You only receive messages when action is required. Thus you save enormous effort for the daily check when delivering to your customers.

Qualified confirmation as audit-proof PDF

Within a few seconds, you can use the online VAT ID auditor to create an audit-proof PDF report with a qualified digital signature. This way, you can prove at any time that you have performed the check in time and that the data is unchanged. In addition, we check with 30 parallel connections, which results in a considerable advantage in performance compared to other solutions.

RESTful API interface

The API interface allows you to integrate and fully automate your processes from SAP, Dynamics Nav – Navision or other systems.

Have we convinced you?

Find out free of charge and without obligation in 15-30 minutes which advantages our solutions also bring to your business case. In the personal product demo, our experts will show you the range of functions of our solutions that are essential for you. We will determine the optimal use case for you based on your requirements. In this way, you optimize your internal processes and save enormous effort.