Comments on the current letter of the Federal Ministry of Finance on intra-Community supplies – Part 5

In this multi-part series of articles, we would like to present to you how the tax authorities are commenting on the changes from 01.01.2020 as part of the so-called “quick fixes”. The principles apply to all deliveries made after 31.12.2019.

We hope you enjoy reading!

BMF letter dated October 9, 2020, III C 3 – S 7140/19/10002.

You can find the BMF letter at:.

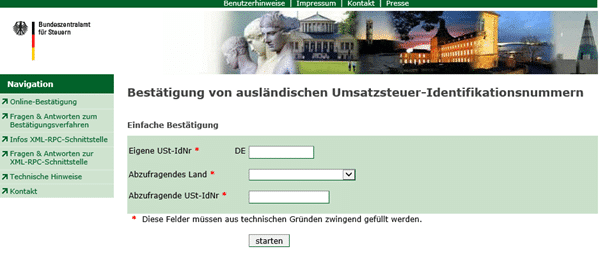

Simple and qualified confirmation of the BZSt (Part I).

1. Why VAT identification number?

With the abolition of internal borders within the EU, border controls and the physical control of border trade also ceased to exist. Instead, an IT-based control procedure was introduced. Here, data is exchanged between the member states. Here, the value added tax identification number (VAT ID) plays a key role. It is used to ensure the correct application of VAT regulations in the European single market.

The VAT registration number is issued to every EU entrepreneur in addition to the tax number.

By using this identifier in intra-Community trade in goods, businesses signal their obligation to pay purchase tax and thus their entitlement to tax exemption on the supply of goods. On the other hand, the VAT number also serves to determine the place of performance and the tax liability for the majority of all services, because the customer thereby indicates that he is an entrepreneur and uses the service for his business.

2. Central importance of the VAT identification number since January 1, 2020.

In the new Section 6a (1) No. 4 UStG, the legislator has legally imposed as a prerequisite for tax exemption that the customer must use a valid VAT ID number issued to him by another Member State vis-à-vis the entrepreneur (i.e. the supplier).

This must be proven by the entrepreneur claiming the tax exemption. He must also satisfy himself as to the accuracy of the information provided by his customer. Pursuant to § 6 a (4) UStG, he only enjoys protection of legitimate expectations if he has checked the information with the due diligence of a prudent businessman.

Entrepreneurs with a valid German VAT registration number have the option of having foreign VAT registration numbers checked in the confirmation procedure.

The VAT identification number (VAT registration number) is a unique identification feature for EU entrepreneurs in the area of VAT. It is used for the processing of intra-Community services. Entrepreneurs participating in the EU internal market need the VAT number.

3. Structure and formal verification algorithms.

The personal VAT number of each taxable person is preceded by a prefix according to the international tax code ISO-3166 Alpha 2 to identify the Member State that issued it. VAT registration numbers issued in the Federal Republic of Germany have 11 digits. The first 2 digits contain the country code “DE”. This is followed by 8 digits (digits) for the identification of the taxable person. The 11th digit is a check digit.

Companies that invoice intra-Community deliveries or provide services on a mass scale and have to submit a recapitulative statement on each date should integrate the plausibility checks into their internal IT systems. In this way, input errors and resulting formal objections by the Federal Central Tax Office can be prevented.

4. How does the verification take place?

According to §18e UStG, the Federal Central Tax Office confirms to the entrepreneur, upon request, the validity of a VAT identification number and the name and address of the person to whom the VAT identification number was issued by another Member State.

5. Confirmation procedure.

You can use the following Internet form to confirm the validity of a foreign VAT ID number. It is accessible daily, in the time between 05:00 and 23:00:

https://evatr.bff-online.de/eVatR/index_html.

Look forward to the next contribution. It will be about the topic “Simple and qualified confirmation of the BZSt (Part II)”!

Note:

The reproduced content is for general information. All contributions are compiled to the best of our knowledge. These are neither intended nor suitable to replace an individual consultation by expert persons under consideration of the concrete circumstances of the respective individual case. No liability can be assumed for their content. Please contact your tax advisor for your individual case.