New VAT number for sole proprietorships in the Netherlands as of January 1, 2020

Mini series: All about the VAT ID number – part 13.

In this multi-part series of articles, we would like to introduce you to what a VAT ID (USt-ID) is. In addition, we would like to cover interesting and worth knowing topics around the topic of USt-ID and shed some light on the subject.

We hope you enjoy reading!

New VAT ID for sole proprietorships in the Netherlands as of January 1, 2020.

That the VAT ID does not have to be permanent is shown by the example of the Netherlands. This is because sole proprietorships in the Netherlands have been assigned a new VAT ID number by the Dutch Tax and Customs Administration since January 1, 2020.

German companies should therefore check the VAT identification number of their Dutch customers stored in their merchandise management systems and ERP systems. This is due to the reallocation of VAT ID numbers to Dutch sole proprietorships as of January 1, 2020. The other Dutch VAT ID numbers are not affected by the changeover and will remain unchanged.

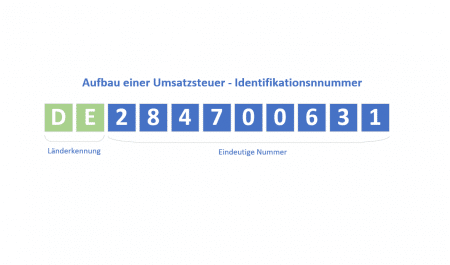

The structure of the VAT ID number for Dutch sole proprietorships is now as follows: The country code “NL” is followed by 12 digits consisting of any consecutive digits, capital letters and the characters “+” and “*”. The digits 11 and 12 are always digits.

Important: The USt-IdNr. previously issued to sole proprietors have lost their validity as of January 1, 2020.

As was the case before January 1, 2020, a VAT ID must be used for intra-Community transactions. The new VAT ID of Dutch customers must therefore be used mandatory since January 1, 2020. Further information is also provided by the Federal Ministry of Finance [in its BMF letter].

For this reason, we recommend that you check the VAT ID of your customers before each intra-Community delivery. This can be done quickly and easily with the Optimus VAT ID checker. Download your free trial version today. For more information and the link to the trial version, please visit the Optimus homepage.