Quick Fixes: The changes to the VAT System Directive at a glance

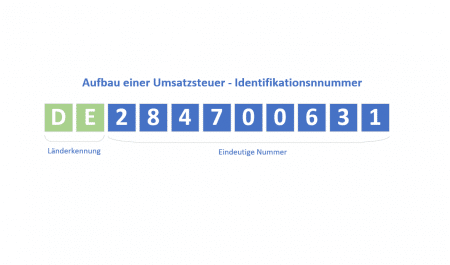

Mini series: All about the VAT ID number – part 6.

In this multi-part series of articles, we would like to introduce you to what a VAT ID (USt-ID) is. In addition, we would like to cover interesting and worth knowing topics around the topic of USt-ID and shed some light on the subject.

We hope you enjoy reading this article!

Quick Fixes: An overview of the changes to the VAT system directive.

As of January 1, 2020, the Quick Fixes have come into force. With the Quick Fixes, the EU Commission has adopted measures on VAT and thereby introduced uniform rules for trade within the EU. We would like to give you an overview of the most important changes.

-

- Tax exemption of intra-community supplies

- Intra-Community series business

- Consignment warehouse

The following three topics can only provide an initial overview of the changes introduced by the Quick Fixes. Due to the complexity of sales tax law and the possible case constellations, we always recommend that you contact your tax advisor.

1. Intra-Community Supplies.

Intra-Community supplies are exempt from VAT under certain conditions. The turnover from the intra-Community acquisition is subject to VAT in the country of destination. Since the beginning of this year, the conditions for tax exemption for intra-Community supplies have been tightened.

Change brought about by the quick fixes for intra-Community supplies.

Due to the new regulations, the verification of the VAT identification number (USt-ID) is of central importance. The specification of the VAT ID of the purchaser becomes a material legal requirement for the tax exemption. This means that if the VAT ID is not provided, the tax exemption cannot be claimed. For this reason, the VAT ID of the customer must be verified and documented.

2. intra-community series transaction.

The new regulation is intended to provide standardization in the EU for intra-Community series transactions. A series transaction exists if several companies conclude turnover transactions over an object. However, the item is transported or dispatched directly from the first supplier to the last customer. Since the movement of goods can be attributed to only one of the supplies, only this supply can qualify for the tax exemption for intra-Community supply.

Change due to the quick fixes for intra-Community series transactions.

The new regulation and its effects in the case of series transactions generally affect the medium-sized company. However, it depends on the specific case constellation. What is meant by this is whether the middle entrepreneur or company transports or ships the goods and which VAT ID (VAT ID) is used. Your tax advisor will be happy to help you find the answer.

3. consignment warehouse.

A consignment warehouse is a warehouse of the supplier near the customer. The customer (buyer) can take goods from the warehouse at any time for his production and trade.

Change due to the Quick Fixes at the consignment warehouse.

Under certain conditions, direct intra-Community delivery to the customer and an intra-Community acquisition by the customer occurs. Intra-Community transfer and taxation in the destination country do not apply. If the VAT requirements are not met or the goods are not removed within the 12-month period, an intra-Community transfer is still to be assumed.

Note on tax issues.

Please note that this can only represent non-binding information and can in no way replace an individual tax consultation with your tax advisor. If you have any questions or uncertainties regarding tax issues, we recommend that you contact your tax advisor.