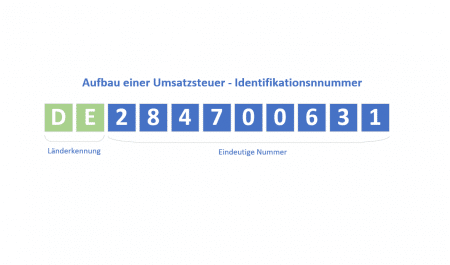

Why should I check the VAT ID and how do I recognize an incorrect VAT ID?

Mini series: all about the sales tax identification number – part 8

In this multi-part article series, we would like to introduce you to what a sales tax ID (VAT ID) is. In addition, we would like to cover interesting topics worth knowing about the topic of USt-ID and shed some light on the subject.

We hope you enjoy reading!

Why should I check the sales tax ID?

For an intra-Community supply between two VAT-exempt entrepreneurs (so-called B2B transaction), proof is required that the other entrepreneur is also the same for VAT purposes.

The VAT entrepreneurial status is the basic requirement for a VAT taxable, but tax-exempt supply or service. On the “recipient side”, this in turn is the basic prerequisite for a taxable intra-Community acquisition with corresponding input tax deduction.

This gives the VAT identification number (VAT ID) a central function. With this, the entrepreneur can check whether the other entrepreneur is an entrepreneur within the meaning of the VAT Act. If this is the case, it is referred to as a B2B transaction.

From January 1, 2020, the recording and retrieval of the VAT ID is even a legal requirement for tax exemption.

How do I recognize a false VAT ID?

The Optimus VAT ID checker provides a convenient, fast and secure VAT ID check. This allows companies to quickly and easily verify their entrepreneurial status for VAT purposes.

In doing so, the VAT ID auditor accesses both the European VIES database and the database of the Federal Central Tax Office (BZSt). Likewise, a qualified confirmation can be requested with a mouse click.

Test the Optimus VAT ID checker for one week free of charge: