Mini-series: All about the VAT identification number

Dear readers,

in the following weeks you will find a mini-series about the VAT identification number every Monday and every Friday.

In this multi-part series of articles, we would like to introduce you to some interesting and interesting facts about the VAT identification number.

We will start next Monday with the first part “What is sales tax, input tax and value added tax?“.

Be curious!

Have a great weekend, your team from Optimus Software.

You may also be interested in:

Comments on the current letter of the Federal Ministry of Finance on intra-Community supplies – Part 4

In this multi-part series of articles, we would like to present how the tax authorities comment on the changes from 01.01.2020 in the context of the so-called “quick fixes”. The principles apply to all delive...

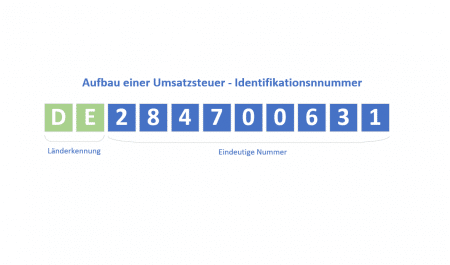

The value added tax identification number (VAT ID No.)

Mini series: All about the VAT ID number – Part 4. In this multi-part series of articles, we would like to introduce you to what a VAT ID (USt-ID) is. In addition, we would like to cover interesting and worth......

Why should I check the VAT ID and how do I recognize an incorrect VAT ID?

Mini series: all about the sales tax identification number – part 8 In this multi-part article series, we would like to introduce you to what a sales tax ID (VAT ID) is. In addition, we would like to cover interest...

What is the EU VAT Information Exchange System (VIES)?

Mini series: All about the VAT ID – Part 3 In this multi-part series of articles, we would like to introduce you to what a Value Added Tax ID (VAT ID) is. In addition, we would like to cover interesting......

Comments on the current letter of the Federal Ministry of Finance on intra-Community supplies – Part 6

In this multi-part series of articles, we would like to present how the tax authorities comment on the changes from 01.01.2020 in the context of the so-called “quick fixes”. The principles apply to all delive...

Comments on the current letter of the Federal Ministry of Finance on intra-Community supplies – Part 1

In this multi-part series of articles, we would like to present how the tax authorities comment on the changes from 01.01.2020 in the context of the so-called “quick fixes”. The principles apply to all delive...